About chapter 13 bankruptcy

Even though a bankruptcy will linger on the credit reviews For many years, you could promptly start to offset that destructive mark with good info. You should definitely shell out just about every bill in time, simply because payment record has the largest influence in your scores.

Consumer Grievance Treatment: You could possibly Make contact with our Client Expert services Division toll-cost-free at: 800-715-9501, e-mail us at [e-mail protected] or immediate mail to your company address detailed on our Make contact with site. A duplicate of our criticism policy and methods is accessible upon ask for.

LendingTree is compensated by businesses on This website and this payment could impact how and where by delivers appear on This great site (such as the get). LendingTree isn't going to incorporate all lenders, financial savings solutions, or bank loan solutions readily available inside the marketplace.

Impact on your credit score may vary, as credit rating scores are independently determined by credit history bureaus based upon several elements such as the economical decisions you make with other fiscal services corporations.

When filing for bankruptcy, it can be crucial to collect and organize all the required documentation to make sure a sleek and effective procedure. Proper documentation don't just will help set up your monetary problem but also performs a big role in analyzing your eligibility and the end result of the case.

Debts can frequently be categorized into priority debts, secured debts, and unsecured debts. Priority debts have Exclusive position as These are thought of a lot more vital than other kinds of personal debt and can't be discharged through bankruptcy.

It can be well worth noting that they are the elemental documents my explanation wanted for many bankruptcy scenarios; nonetheless, additional documentation or precise specifications may well vary depending on the form of bankruptcy you are filing (e.

The objective behind this analysis is to ensure that All those with confined fiscal assets have access to the main advantages of Chapter seven bankruptcy, which permits next page the discharge of unsecured debts without having repayment options.

For the subsequent a few to 5 years, you’ll fork out your trustee and they will distribute money in your creditors. You may’t find out this here choose out new personal debt without having your trustee’s permission whilst below your repayment plan. You’ll need to Are living inside of a finances, due to the fact your disposable profits will go toward debt.

In the event your disposable revenue explanation falls in acceptable restrictions determined by bankruptcy laws and recommendations, you are able to even now qualify for zero-down bankruptcy.

We are able to’t convey to a bankruptcy decide that we agreed to a payment system with you you have no hope of having the ability to pay. That could get us in difficulty While using the courtroom and The federal government

The initial consultation is complimentary. While this is one of our favourite resources for dependable personal debt consolidation, There are some states whose inhabitants won't be eligible for CuraDebt's expert services.

If you need to help save your property or have more other belongings you want to ensure you shield, then you might want to have some enable when you file for Chapter 13 bankruptcy.

You need to maintain particular belongings or else you’re driving in your home finance loan or car payments and need to make them up as time passes.

Michael J. Fox Then & Now!

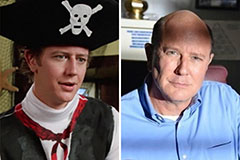

Michael J. Fox Then & Now! Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Nancy Kerrigan Then & Now!

Nancy Kerrigan Then & Now! Nancy McKeon Then & Now!

Nancy McKeon Then & Now! Samantha Fox Then & Now!

Samantha Fox Then & Now!